Financial literacy

Financial literacy

Classes had already started when Arno and his father arrived at the schoolhouse.

This single sentence from Oskar Luts’ “Spring” must have been well understood by everyone at school and probably still remembered.

But how much does anyone remember about percentage calculations in mathematics they learned in the next class, or do they know the meaning of compound interest?

Based on the data from a study conducted in 2016 by the Organization for Economic Cooperation and Development (OECD) mediated by the Ministry of Finance, this should also be very clear because, in a comparison of 30 countries, Estonian residents were in third place in terms of their financial knowledge, ahead of Finland and immediately after Hong Kong and South Korea. It would be great if the practical application of this valuable knowledge were not so rare. According to the same study, Estonians are unfortunately only in 24th place, or sixth from the bottom, regarding their actual financial behaviour.

But how can we better use this knowledge in practice?

The ability to apply mathematics in real life is often called financial literacy or money wisdom. The Ministry of Finance has created a seven-year programme to promote financial literacy. Still, money wisdom could be described as the ability to distinguish wheat from chaff, that is, what, when and how it is more sensible to buy.

“As you sow, so shall you reap.

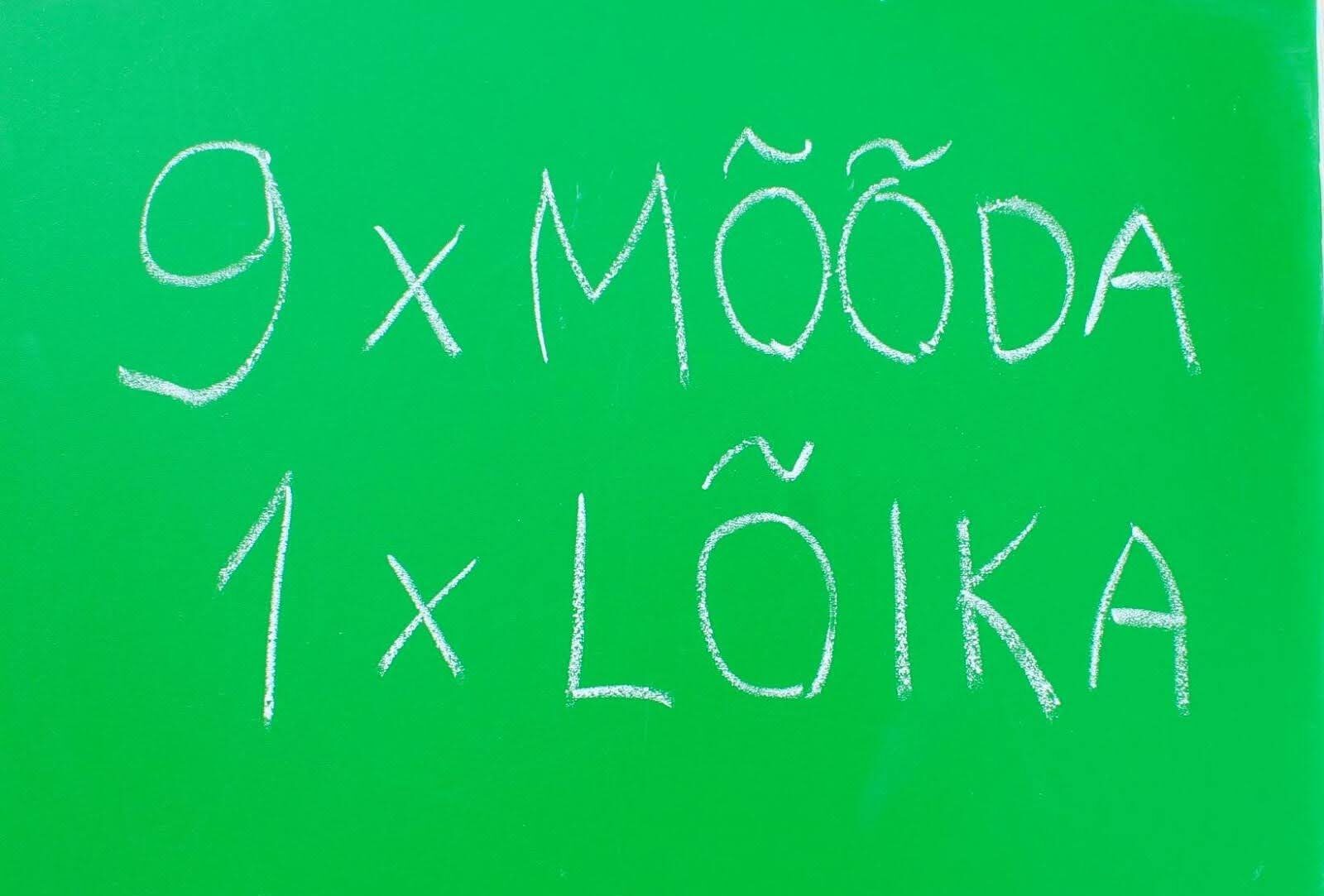

The most important lesson or skill in money wisdom is awareness. People buy with their eyes and are by nature, hoarders. We simply like to stock up, just in case, for rainy days. Therefore, start planning. However, how many families make a shopping list when they go shopping? Probably very few. Planning helps you spend more wisely and frugally, buy only the things you need, and avoid making unnecessary purchases altogether.

“A horse in the summer, a cart in the winter.

However, to make essential expenses, choose a suitable time if possible. For example, when the purchase of your desired goods or services is more affordable, there are discounts and end-of-season sales. When choosing, also remember quality, as no one is so wealthy as to buy things that are too cheap. Do not postpone expenses that will help you save money, such as renovating your heating system, which will help you significantly reduce future utility costs.

“Measure nine times, cut once.

Another helpful skill worth learning and remembering is choosing correctly. Choosing is not only necessary when making phone calls or voting for politicians. Similarly, choosing is essential every time we decide to buy or not to buy something.

By choosing, we decide in favour of one possible option and simultaneously leave aside all other possibilities. Therefore, knowing and considering the different solutions offered – alternatives is crucial.

“More precious than treasures of silver,

More precious than loads of gold

Wisdom must be acknowledged.

However, the alternatives can be very different depending on the person. For example, you can choose one, two or three loaves of bread from the store. You can find it in another store as well. But you can also buy it from a cafe, directly from a baker, bake it yourself or buy bread instead. But the most important thing is to consider the cost or price of all the options and choose the most beneficial for you.