Everything about boat insurance in Estonia: hull protection, liability cover, costs, claims process. Compare major providers and find the right policy.

Boat insurance in Estonia: hull, liability and small craft cover

Owning a boat in Estonia opens up a world of possibilities—from cruising the Gulf of Finland to exploring the sheltered waters of Väinameri or spending lazy summer weekends on Lake Peipus. But with that freedom comes responsibility, and understanding how to properly insure your vessel is essential for any boat owner.

This guide breaks down everything you need to know about boat insurance in Estonia: what it covers, when you need it, which local providers offer the best options, and how to make a claim when something goes wrong.

Whether you own a small motorboat, a racing yacht, or a jet ski, you’ll find practical information to help you make informed decisions.

What is boat insurance and when do you need it in Estonia?

Boat insurance in Estonia is generally voluntary for private recreational use, but it becomes practically mandatory in many real-world situations. Marinas, regattas, and finance companies often require proof of cover before granting access or releasing funds.

In Estonian terminology, “boat insurance” typically refers to a combination of hull (casco) and third party liability insurance for small craft up to 24 metres in length, registered in the Estonian Register of Recreational Craft managed by the Transport Administration.

Here’s when boat insurance becomes a practical necessity rather than just a good idea:

Marina access: Popular harbours like Pirita Yacht Club, Haven Kakumäe, and Leppneeme require liability cover before they’ll allocate a berth

Regatta participation: Events like Muhu Väin demand minimum liability limits (typically around €200,000) as an entry condition

Leasing and loans: Finance companies insist on comprehensive hull cover to protect their security interest

Crowded harbours: Mooring in busy ports like Pärnu or Kuressaare carries higher collision risk, making cover sensible

High-value craft: Owners of expensive motor yachts or sailing yachts naturally want protection for their investment

Concrete examples of insurable boats include a 6-metre motorboat used on Lake Peipus, a 12-metre sailing yacht based in Tallinn Bay, or a personal watercraft kept on a trailer in Harju County.

Both private owners and companies can insure boats used for leisure, training, charter, or mixed purposes. However, dedicated racing yachts or charter operations may need special terms and conditions beyond standard recreational policies.

Which types of boats and watercraft can be insured?

Estonian insurers cover most recreational craft up to around 24 metres in length. Very large yachts or superyachts typically require specialised policies from international insurers or Lloyd’s syndicates accessed through brokers like Kominsur.

Motor-powered craft:

Outboard motorboats and fishing boats

Cabin cruisers and motor yachts

RIBs (rigid inflatable boats)

Speedboats and wakeboard boats

Jet skis and personal watercraft

Small motor launches for lake and coastal use

Wind-powered craft:

Sailing dinghies and keelboats

Cruising and racing yachts

Catamarans and trimarans

Day sailers and club boats

Vessels participating in local regattas (when agreed in the policy)

Human-powered craft:

Rowing boats and sculls

Canoes and kayaks

SUP boards (stand-up paddleboards)

Small pedal boats

For human-powered craft, some companies only insure them as part of a household contents policy or bundled with another vessel. Insurers typically limit cover to recreational use, training, and club racing. Commercial passenger transport or heavy charter operations are usually excluded unless specifically negotiated.

Main types of boat insurance cover

Estonian insurers generally structure boat insurance into two main components—hull (casco) and liability (TPL)—with optional add-ons available for trailers, personal accidents, and equipment.

Hull insurance (casco): Protects the physical vessel including hull, deck, engine, masts, sails, rigging, fixed navigation equipment, and sometimes the tender or dinghy. Cover can be “named perils” (specific risks listed) or “all-risk” (broader protection with stated exclusions)

Liability insurance (TPL): Covers your legal responsibility for bodily injury or property damage caused to third parties—other boats, marina infrastructure, swimmers, or bystanders

Trailer insurance: Add-on cover for the boat trailer (typically 750–3,500 kg capacity) during road transport and storage

Personal accident cover: Optional protection for skipper and crew members in case of injury or death during boating activities

Personal effects and equipment: Cover for sports gear, fishing equipment, electronics, and personal belongings kept on board

Major insurers like If, ERGO, Seesam, and BTA typically offer two plan levels: a basic package covering named perils (fire, theft, storm, collision) and an extended “all-risk” version that includes accidental damage from various causes. Brokers such as IIZI and Optimal can help compare these options across multiple providers.

What hull (casco) insurance usually covers

Hull insurance protects your boat both on the water and on land—during winter storage, maintenance periods, and transport on a trailer.

Typical covered events include:

Collision and impact: Striking another craft, hitting a pier, or colliding with floating debris in the Gulf of Finland

Running aground: Contact with rocks in Väinameri, sandbars on Lake Võrtsjärv, or unmarked shallows near the islands

Underwater hazards: Damage from submerged rocks near Naissaar or logs drifting in shipping lanes

Storm and wind: Structural damage from autumn gales in the Baltic, torn sails, or broken rigging

Lightning strike: Direct hits to mast and electronics, common during summer thunderstorms over Estonian waters

Fire and explosion: Engine compartment fires, galley gas leaks, or shore-power short circuits in marina

Theft and robbery: Stolen outboard motor from a Pärnu marina berth, burglary from a locked cabin

Vandalism: Malicious damage to hull, instruments, or equipment while moored or in storage

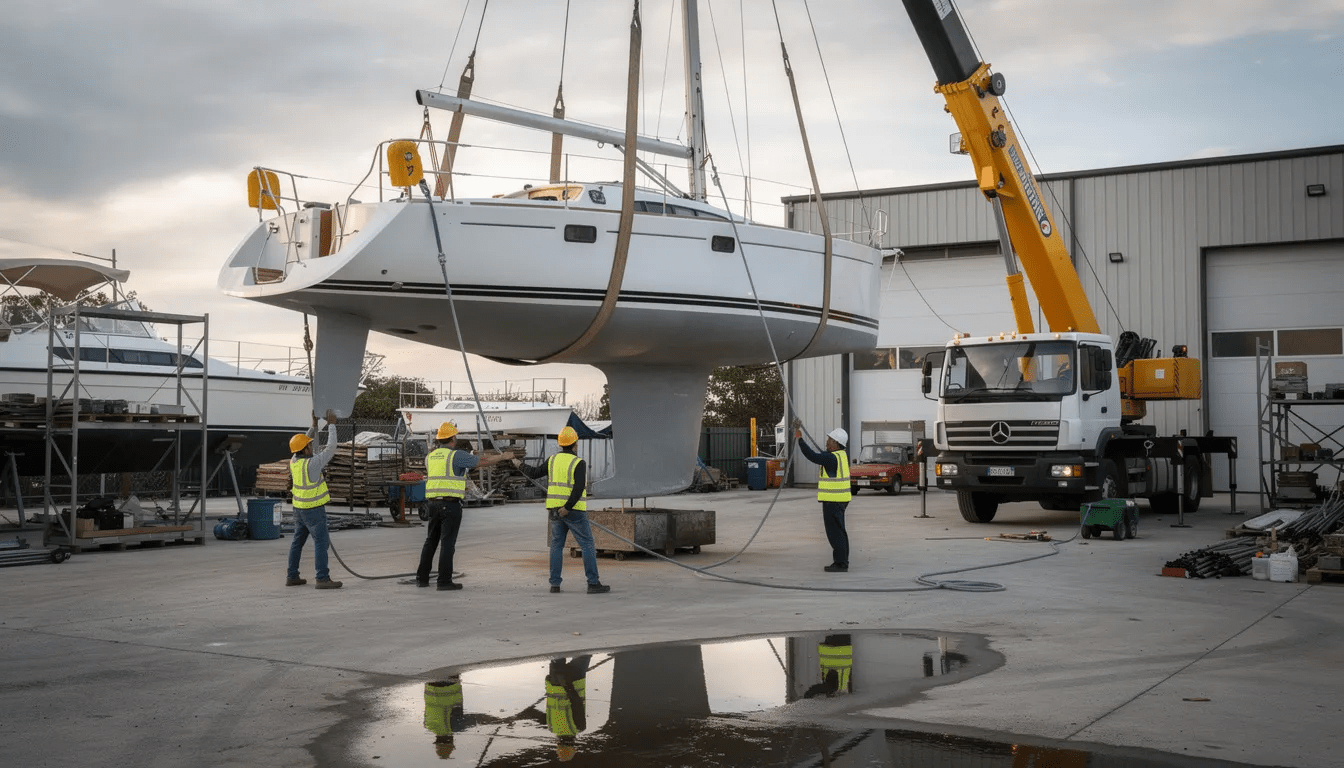

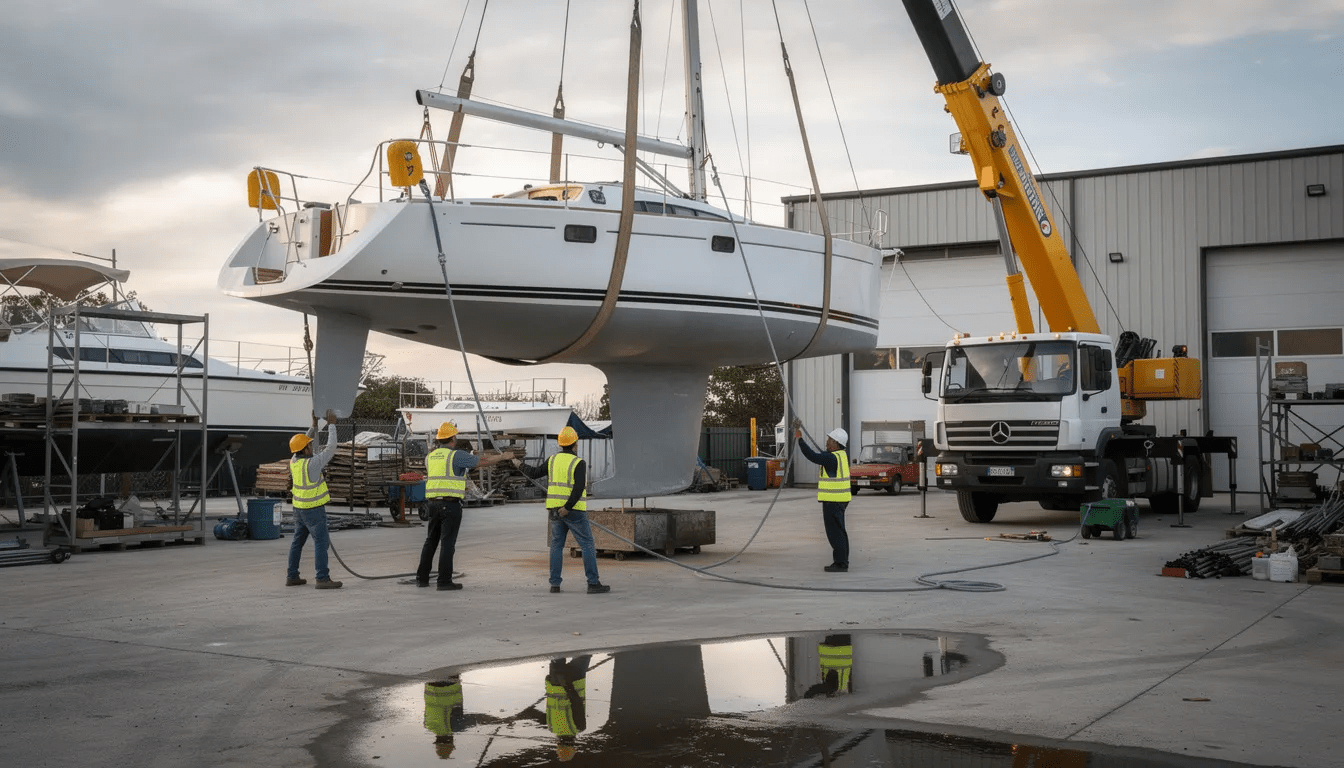

“All-risk” policies may also cover accidental damage like dropping the mast during stepping, crane mishaps during launch or haul-out, or damage while towing the boat on its trailer within policy terms.

What liability (TPL) insurance usually covers

Liability insurance protects you as the boat owner—and any authorised operators—against financial claims from third parties who suffer bodily injury or property damage due to your vessel.

Real-world scenarios covered by TPL include:

Regatta collisions: Striking another yacht during a Kalev Yacht Club race and damaging their expensive carbon mast

Marina incidents: Hitting a rented pontoon in Haapsalu harbour or scraping a neighbouring vessel while manoeuvring

Injury to others: A water-skier or swimmer injured by your boat or propeller

Wake damage: Your wash damaging a moored craft or causing someone to fall on a pier

Liability limits in Estonia are typically expressed per event, ranging from €100,000 to €500,000. Some regattas and marinas specify minimum requirements—Muhu Väin, for example, requires around €200,000 in liability cover for entry.

TPL policies usually include legal defence costs if a claim goes to court or arbitration. However, damage to your own boat, injuries to your crew, or claims from close family members are generally not covered under liability—these fall under hull insurance, accident cover, or health insurance.

Risks on water and on shore: what can happen to your boat?

Most insurance claims in Estonia relate to a predictable set of incidents: collisions, running aground, storm damage, and theft of engines or equipment. Understanding these risks helps you choose appropriate cover.

Collision and underwater obstacles: Rocky bottoms near islands like Naissaar and Prangli, shifting shallows in Väinameri, and floating logs near cargo routes all pose threats. Outboard motors and propellers are especially vulnerable to damage from underwater impacts

Storm, ice, and weather: Sudden squalls on the Gulf of Finland can develop quickly, while October and November bring the strongest autumn storms. Boats left unattended may suffer ice pressure or damage from wet snow collapsing winter covers

Fire hazards: Older wiring, DIY electrical modifications, fuel leaks, and heaters left running in marina berths all contribute to fire risk. Shore-power issues on crowded pontoons add another danger

Theft and vandalism: Engines stolen from open trailers in Tallinn suburbs, electronics taken from locked cabins in Tartu river marina, and vandalism to boats left on public shorelines are all too common

Transport and storage: Damage during crane lifting at boatyards, boats slipping from trailers on country roads, and mishaps in winter storage sheds represent significant land-based risks

Ice damage: Early spring launches or late autumn cruising in the Gulf of Riga can expose boats to floating ice that damages hulls and running gear

Where and how is your boat covered? Navigation and storage areas

Insurance policies define both geographic navigation areas and periods of use versus storage. These factors significantly affect both pricing and the scope of your cover.

Domestic waters: Standard policies cover Estonian coastal waters including the Gulf of Finland, Gulf of Riga, and Väinameri, plus internal waters like Lake Peipus, Lake Võrtsjärv, and rivers like Emajõgi

Extended Baltic coverage: For cruising to Finland, Sweden, or Latvia, you’ll need to extend your navigation area—often available as an optional upgrade

Road transit: Many policies automatically cover transport by road, including ferry crossings on routes like Virtsu–Kuivastu and Rohuküla–Heltermaa while the craft is on its trailer

Seasonal considerations: Full 12-month policies cover navigation, lay-up, and both summer and winter storage. Some owners opt for reduced cover during the off-season (typically October to April) when the boat sits ashore

Foreign regattas and cruises: If you’re planning a longer Baltic cruise (say, Tallinn–Stockholm–Åland) or participating in foreign events, notify your insurer and extend both the navigation area and liability limits before departure

Requirements, registration and documents for boat insurance

Most Estonian insurers require recreational craft to be properly registered and maintained before issuing hull cover.

Registration requirement: Vessels must typically be entered in the Estonian Register of Recreational Craft (Transport Administration) when their length, engine power, or intended use triggers registration requirements. Unregistered boats may only qualify for limited coverage or liability-only policies

Application documentation: Insurers commonly request the registration certificate, proof of ownership or purchase agreement, and multiple photos showing the hull, bow, stern, registration number, engine, control panel, and interior

Vessel details: Expect questions about year of construction, hull material (GRP, aluminium, wood), engine type and power, previous damage history, and your planned area of use—all factors in calculating the premium

Survey requirements: For higher sums insured or older vessels, companies may require a recent survey report or technical inspection before offering comprehensive “all-risk” cover

Ownership proof: Bills of sale, import documents, or inheritance papers may be needed for used boats or vessels transferred between owners

Boat insurance options and major providers in Estonia

The Estonian market offers several strong local insurers and brokers with tailored products for recreational boats and yachts up to 24 metres.

Direct insurers:

If Insurance: Recreational craft insurance combining hull and liability, with options for leisure and regatta sailing. Offers ignition lock discounts and year-round cover for sailboats and motorboats alike

ERGO Insurance: Boat hull and liability packages for private and corporate clients. Offers basic versus extended cover levels with emphasis on claims handling for risks like storm damage and running aground

Seesam Insurance: Small boat insurance for vessels registered in the Estonian Register of Recreational Craft. Covers hull, masts, sails, motors, and equipment for recreational craft

BTA Insurance (bta.ee): Covers risks while your craft is in the water, moored, or being transported via trailer. Popular choice for smaller motor boats and speedboats

Optimal and IIZI: Function as intermediaries and online platforms offering quotes from multiple insurers for small boats—useful for quick price comparisons

Specialist brokers:

Kindlustusest: Online comparison tool covering multiple insurers, helpful for standard motorboats and straightforward recreational craft

Inpro Insurance Brokers: Specialises in tailored solutions for high-value yachts and corporate fleets requiring more complex arrangements

Kominsur: Provides access to large European insurers and Lloyd’s syndicates for complex, high-limit, or offshore cruising risks that exceed standard local offerings

Choosing between a direct insurer and a broker depends on your needs. Direct insurers offer simplicity and a single point of contact. Brokers provide access to multiple markets and can arrange specialised cover for unusual risks or international cruising.

How much does boat insurance cost and what affects the premium?

Premiums in Estonia vary widely—from under €100 per year for small rowing boats or kayaks to several hundred euros for mid-sized motorboats, and over €1,000 for larger motor yachts with comprehensive Baltic coverage.

Key pricing factors include:

Boat value and length: A 6-metre used motorboat worth €8,000 costs much less to insure than a 13-metre cruising yacht valued at €150,000

Engine power and type: High-horsepower speedboats and fuel-hungry motor yachts attract higher premiums than modest outboard motors or sailing yachts with auxiliary engines

Age and construction: Newer vessels in good condition with modern equipment cost less to insure. Older wooden boats or those without proper CE marking may face higher rates or limited availability

Claims history: A clean record over several years earns better rates; previous claims push premiums up

Navigation area: Cover limited to Estonian coastal and inland waters costs less than full Baltic Sea or extended Scandinavian cruising

Storage and security: Boats kept in guarded marinas or indoor winter storage qualify for discounts of 5–15% compared to those left on public moorings or open trailers

Deductible choice: Higher self-risk (excess) amounts reduce your premium but mean more out-of-pocket expense when claiming

Add-ons: Trailer cover, personal effects protection, crew accident insurance, and higher liability limits (such as €500,000) all increase the total cost

Typical exclusions and limitations you should know

Every boat policy contains important exclusions. Before purchasing, read the insurer’s terms and conditions carefully—If, ERGO, Seesam, BTA, and others publish these documents online.

Common exclusions:

Wear and tear: Gradual deterioration, corrosion, osmosis, ageing of materials, or general maintenance issues are never covered

Mechanical breakdown: Engine failure, electrical faults, or equipment malfunction not caused by an external insured event (collision, fire, etc.) are excluded

Manufacturing defects: Problems arising from faulty design or production faults fall outside normal policy cover

Operational exclusions:

Undeclared racing: Speed trials or competitive racing not declared and agreed in the policy may void cover for any resulting damage

Navigation area breaches: Operating outside your agreed geographic zone or sailing during a period when cover is suspended (winter lay-up, for example)

Overloading: Exceeding the boat’s rated capacity for passengers, cargo, or equipment

Commercial use: Using a privately-insured boat for paid charter, passenger transport, or other business purposes

Security-related restrictions:

Inadequate anti-theft measures: Theft of an outboard motor not secured with an approved lock, or a boat left on a public shore without proper mooring

Unsecured storage: Unlocked storage areas or failure to follow marina security requirements

Alcohol and negligence:

Intoxicated operation: Incidents occurring when the skipper is under the influence of alcohol or drugs typically result in reduced compensation or complete claim denial

Lack of qualifications: Operating a vessel without required licences or certificates where Estonian law mandates them

Practical tips to choose the right boat insurance

The best policy balances price, cover breadth, and claims service—not simply the lowest premium. Cheap insurance that doesn’t pay when you need it wastes both money and peace of mind.

Define your actual usage: Weekend summer sailing on Lake Peipus requires different cover than regular Tallinn–Helsinki crossings or active regatta participation along the coast. Be realistic about where and how often you sail

Compare like with like: Request at least three quotes (from If, ERGO, and Seesam/BTA via IIZI or another broker) using the same sum insured, deductible, and navigation area. Otherwise, comparisons are meaningless

Check claims reputation: Ask other boat owners about their experience. Look for insurers with responsive claims teams, relationships with local boatyards in Tallinn, Pärnu, and Saaremaa, and 24/7 emergency contacts in Estonian and English

Set realistic sums insured: Base your cover on current market value in Estonia (check boat sale ads, broker valuations) rather than the purchase price from several years ago. Under-insurance leaves you exposed; over-insurance wastes premium

Read the exclusions: Understand exactly what isn’t covered before you need to claim. Pay special attention to racing, navigation area limits, and security requirements

Consider bundling: Some insurers offer discounts for multiple policies (home, car, boat) or for insuring both the vessel and its trailer together

How to make a claim if something happens

Estonian insurers allow online, phone, and sometimes mobile-app claim notifications. The speed and quality of your documentation directly affects how quickly your claim is settled.

Immediate steps after an incident:

Ensure safety: Make sure all people are safe. Prevent further damage if possible—pump out water, secure broken equipment, move to shelter if safe to do so

Document everything: Take photos and videos of the damage, the location, and any relevant surroundings. Capture GPS coordinates if possible. Collect contact details from any witnesses

Report to authorities: For serious incidents, theft, or accidents involving injury, file a report with the Police and Border Guard Board. Some marinas also require incident logs

Notify your insurer promptly: Contact If, ERGO, Seesam, BTA, or your broker as soon as practical. Most require notification within a specified timeframe (often 24–72 hours)

Information your insurer will request:

Policy number and insured vessel details

Date, time, and exact location of the incident

Detailed description of what happened

Photos and videos of damage

Details of any other parties involved (other boat owners, marina, etc.)

Official reports if applicable (police, harbour master)

Repair and settlement process:

Obtain repair estimates from local workshops (Tallinn, Pärnu, Kuressaare boatyards are commonly used)

For larger claims, expect a surveyor appointed by the insurer to inspect the damage

Do not authorise major repairs or agree compensation with third parties before coordinating with your insurer

Emergency mitigation work (preventing further damage) is usually permitted and reimbursable

Important: Keep all receipts and records of any expenses incurred as a result of the incident. This includes emergency towing (which can cost €400+ per hour in some cases), temporary mooring, and protective measures.

Summary

Boat insurance in Estonia combines hull (casco) and liability (TPL) cover for recreational craft up to 24 metres

While technically voluntary for private use, insurance is practically required for marina access, regatta entry, and financed vessels

Major local providers include If, ERGO, Seesam, and BTA, with brokers like Kindlustusest, Inpro, and Kominsur offering comparison and specialist options

Premiums depend on boat value, size, engine power, navigation area, security measures, and claims history

Always read exclusions carefully—racing, commercial use, alcohol, and security lapses can void your cover

Document any incident thoroughly and report to your insurer promptly for the smoothest claims process

Whether you’re insuring a small rowing boat for summer weekends or a motor yacht for Baltic cruising, taking time to understand your options pays dividends.

Compare multiple quotes, match cover to your actual needs, and choose an insurer with a solid local claims network.

That way, when something does happen—and on the water, something eventually will—you’ll be prepared.