A comparison of online shopping baskets revealed a surprising result: food prices in major retail chains have dropped to levels seen a year ago. For instance, a shopping cart at Rimi costs less now than in the past 11 months; last year, it was over €70, and now it’s under €63. Barbora’s cart is also €6 cheaper than last September. Data is collected on the 10th of each month. Prisma still hasn’t returned to its previous year’s prices and currently offers a cart that’s €5 more expensive. Selver’s prices are €2 higher than 11 months ago. Rimi is experimenting with...

Read MoreNews Feed

Estonian property market sees 33% drop in transactions

Estonian property market sees 33% drop in transactions YoY; No Immediate Revival Expected Despite ECB Holding Off Rate Hikes Despite the European Central Bank (ECB) pausing interest rate increases, experts foresee no quick recovery for Estonia’s flagging housing market. Since last autumn, the ECB has raised rates ten times to counter inflation. This has discouraged new lending and affected existing loan holders, states Risto Vähi, an analyst at Uus Maa. Year-on-year data reveals one-third fewer property transactions, confirms Vähi. Mihkel Eliste of Arco Vara has observed a declining trend since the spring-summer period of 2022. He notes the apartment market...

Read More10 best arbitrage software platforms reviewed [+ tested]

The top arbitrage betting software sites were tested and reviewed for global sports bettors. Discover what they offer, key features and what to look for when choosing arbitrage betting software.

Read MoreBest betting tipsters – what are they tipping to win today?

Discover how expert betting tipsters, strategies, and free tips can help you make informed decisions, boost profits, and improve your sports betting journey.

Read MoreKnow the game: what smart fans need to know about Cricket

Learn how to follow and bet on cricket. Understand formats, tactics, conditions, and betting markets to enjoy this classic sport with confidence.

Read MoreKnow the game: what smart fans need to know about Field Hockey

Discover the fast-paced world of field hockey. Learn how the game is played, understand team tactics, and explore what makes this Olympic sport so compelling.

Read MoreKnow the game: what smart fans need to know about Curling

Master the basics of curling—strategy, scoring, and team dynamics. Learn how to follow the action and place smarter bets on this tactical winter sport.

Read MoreKnow the game: what smart fans need to know about Floorball

Fast-paced and high-scoring, floorball blends speed, tactics, and skill. Learn how the sport works and why it’s gaining global attention indoors.

Read MoreKnow the game: what smart fans need to know about Cycling

From stage races to sprints, learn how cycling works and how to bet smartly. Understand team tactics, terrain, and top tips for betting on the sport.

Read MoreKnow the game: what smart fans need to know Alpine Skiing

Learn how to bet on alpine skiing with tips on form, conditions, and event types. A fast-paced, high-risk sport with real value for informed bettors.

Read MoreKnow the game: what smart fans need to know Badminton

Discover the fast-paced world of badminton, from match formats to Olympic glory. Learn how the sport works and what makes it exciting to follow year-round.

Read MoreKnow the game: what smart fans need to know about Darts

Darts is fast, fierce, and full of surprises. Learn how the game works, what affects outcomes, and how to bet wisely on this crowd-favourite sport.

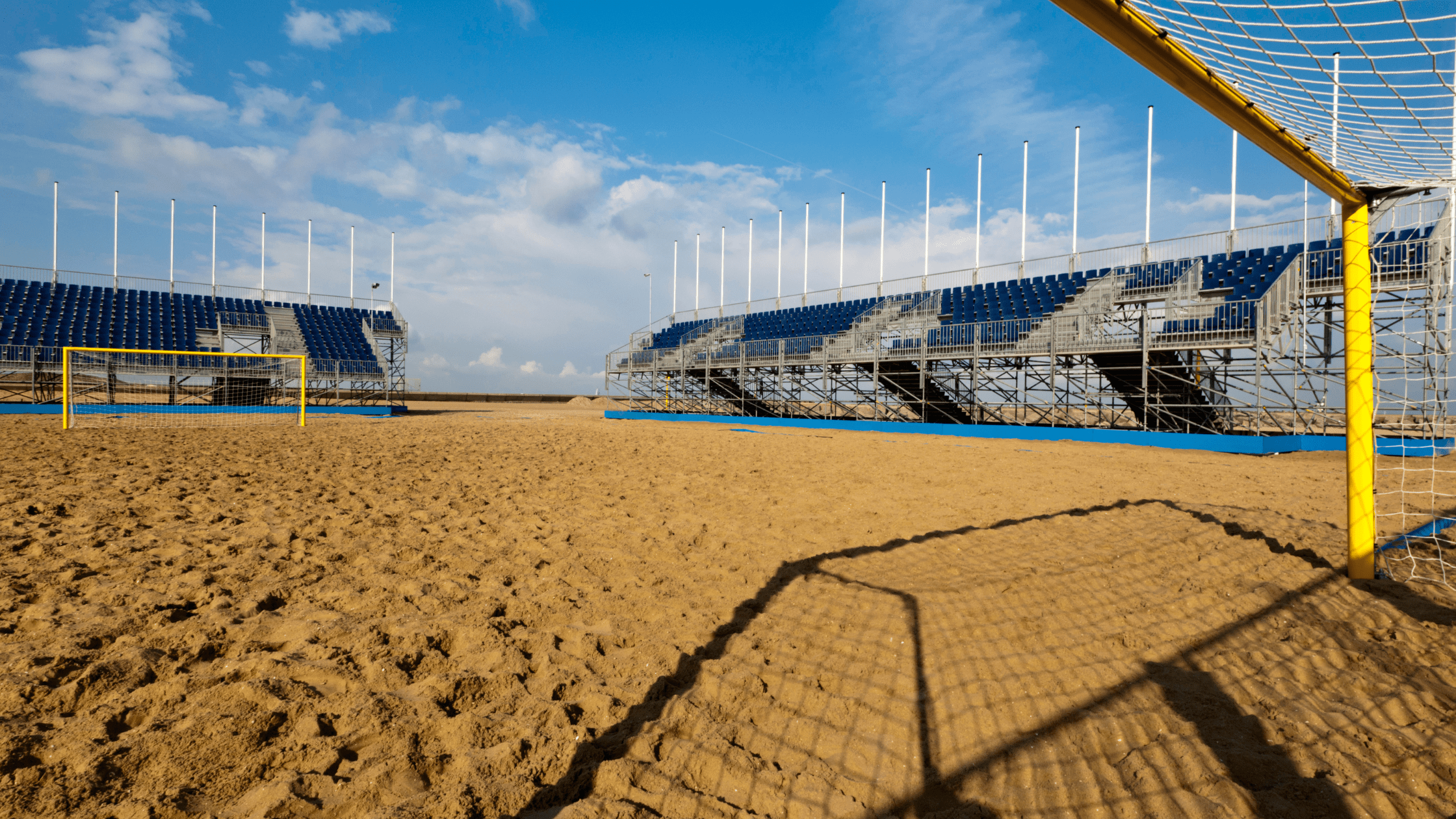

Read MoreKnow the game: what smart fans need to know Beach Football

Explore the unique world of beach football—fast goals, sandy pitches, and flair-filled play. Learn what makes this sun-soaked sport exciting to follow.

Read MoreKnow the game: what smart fans need to know Mixed Martial Arts

Learn how to follow and understand Mixed Martial Arts (MMA). From rules to betting markets, get to grips with the world’s fastest-growing combat sport.

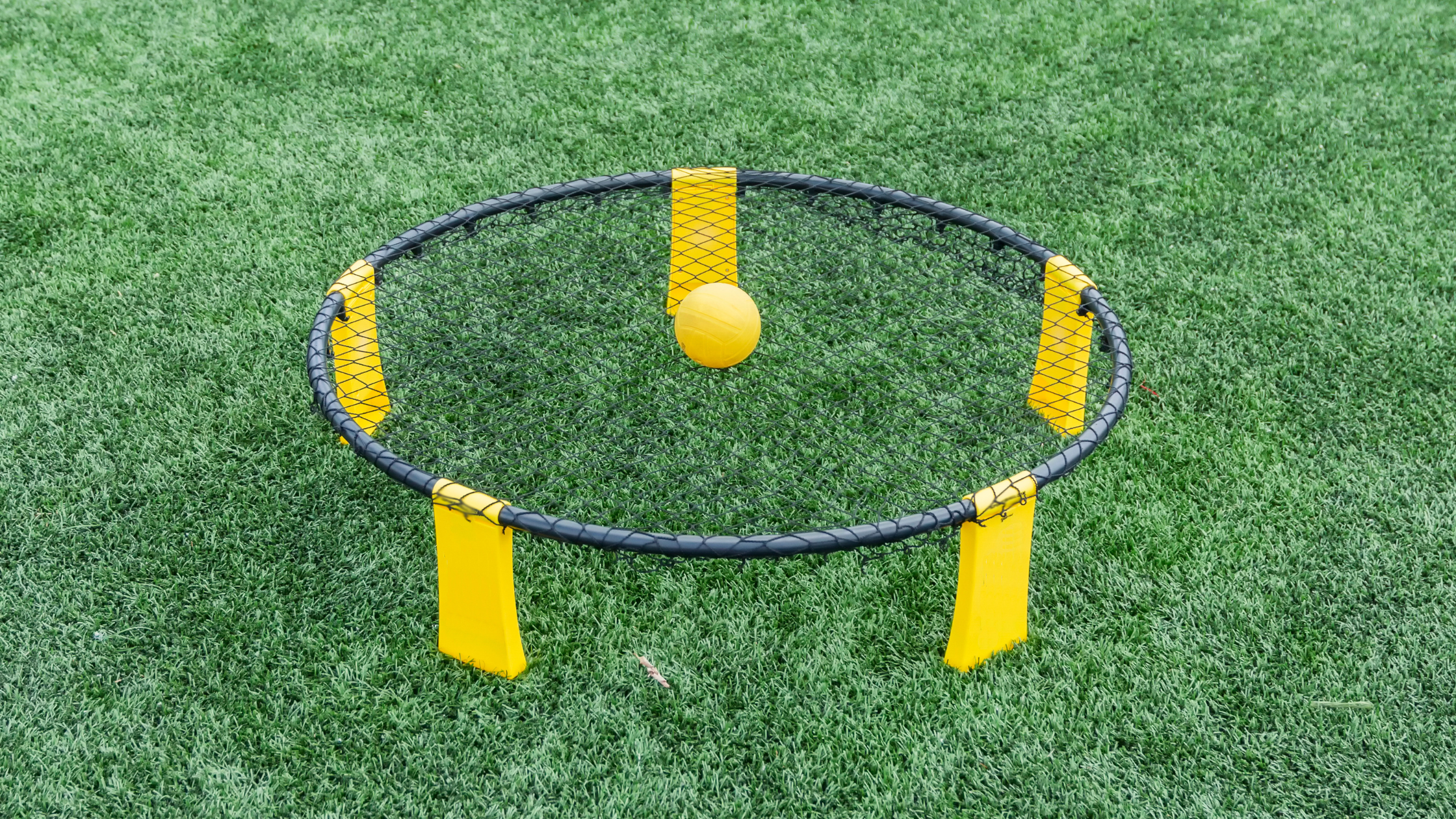

Read MoreKnow the game: what smart fans need to know about Spikeball (Roundnet)

Discover how to watch and understand Spikeball, the fast-paced team sport also known as Roundnet. Learn its rules, tactics, and what makes it so addictive.

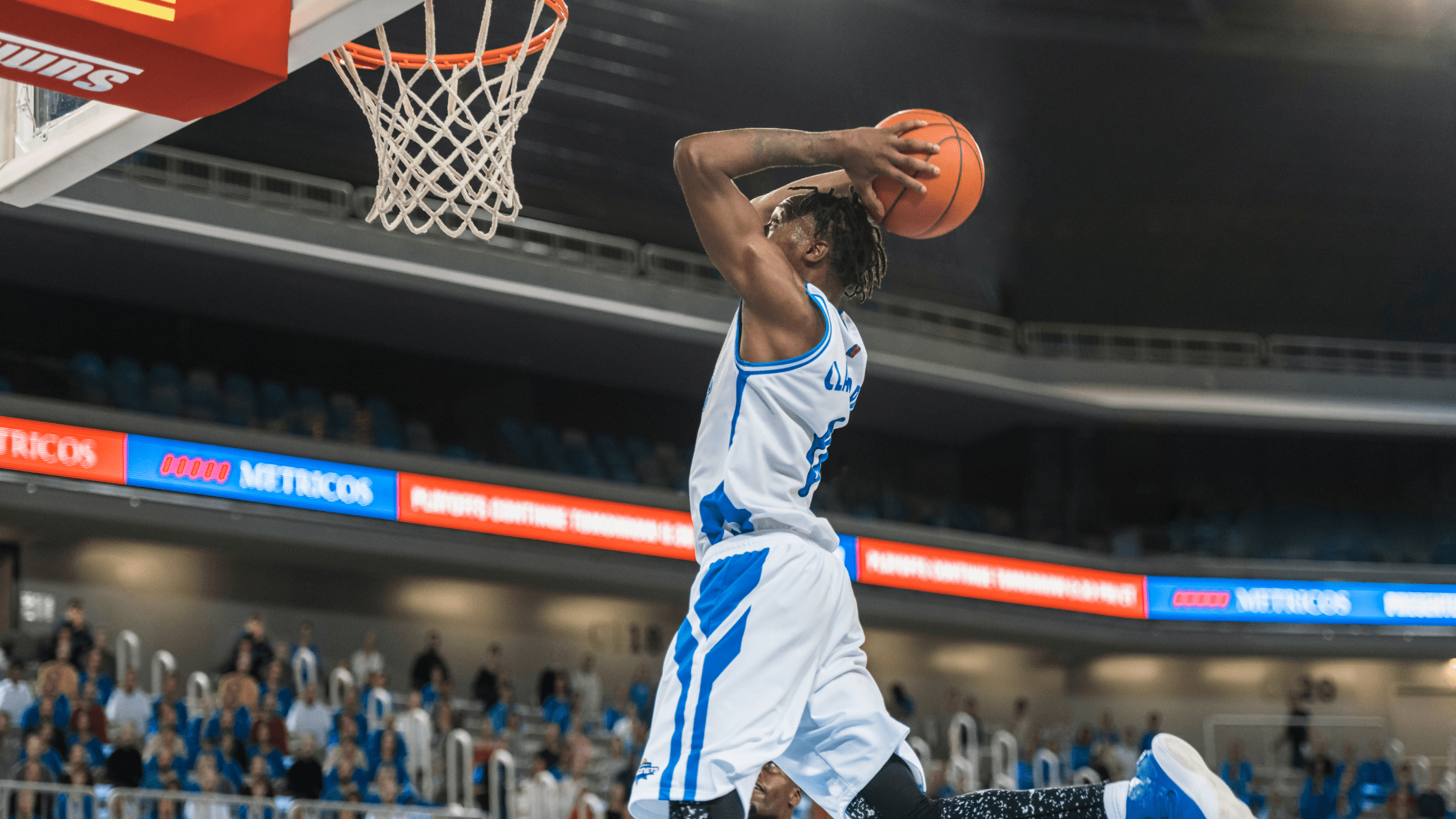

Read MoreKnow the game: what smart fans need to know about Basketball

Understand basketball’s fast-paced tactics and scoring. Learn how to watch, enjoy, and start betting on the game with confidence.

Read MoreKnow the game: what smart fans need to know about Futsal

Futsal blends flair, speed, and precision in a fast-paced five-a-side format. Learn the rules, skills, and structure that make this indoor football variant unique.

Read MoreKnow the game: what smart fans need to know about Golf

Explore golf’s major championships, key global events, and rising breakaway leagues. A clear guide to what shapes the sport’s competitive calendar.

Read MoreKnow the game: what smart fans need to know about Water Polo

Discover the rules, tactics, and betting insights of water polo—a fast, physical team sport with high-scoring potential and global appeal.

Read MoreKnow the game: what smart fans need to know about Handball

Understand handball’s fast-paced action, key rules, and top betting markets. Learn how the sport works before placing a smart, well-informed wager.

Read MoreKnow the game: what smart fans need to know eSports

Discover the 7 biggest eSports tournaments by prize pool, prestige, and viewership—essential knowledge for fans, bettors, and competitive gaming followers.

Read MoreKnow the game: what smart fans need to know about Baseball

Learn baseball rules, stats, and strategy to bet smarter. A fan’s guide to understanding the game and spotting real value in baseball betting markets.

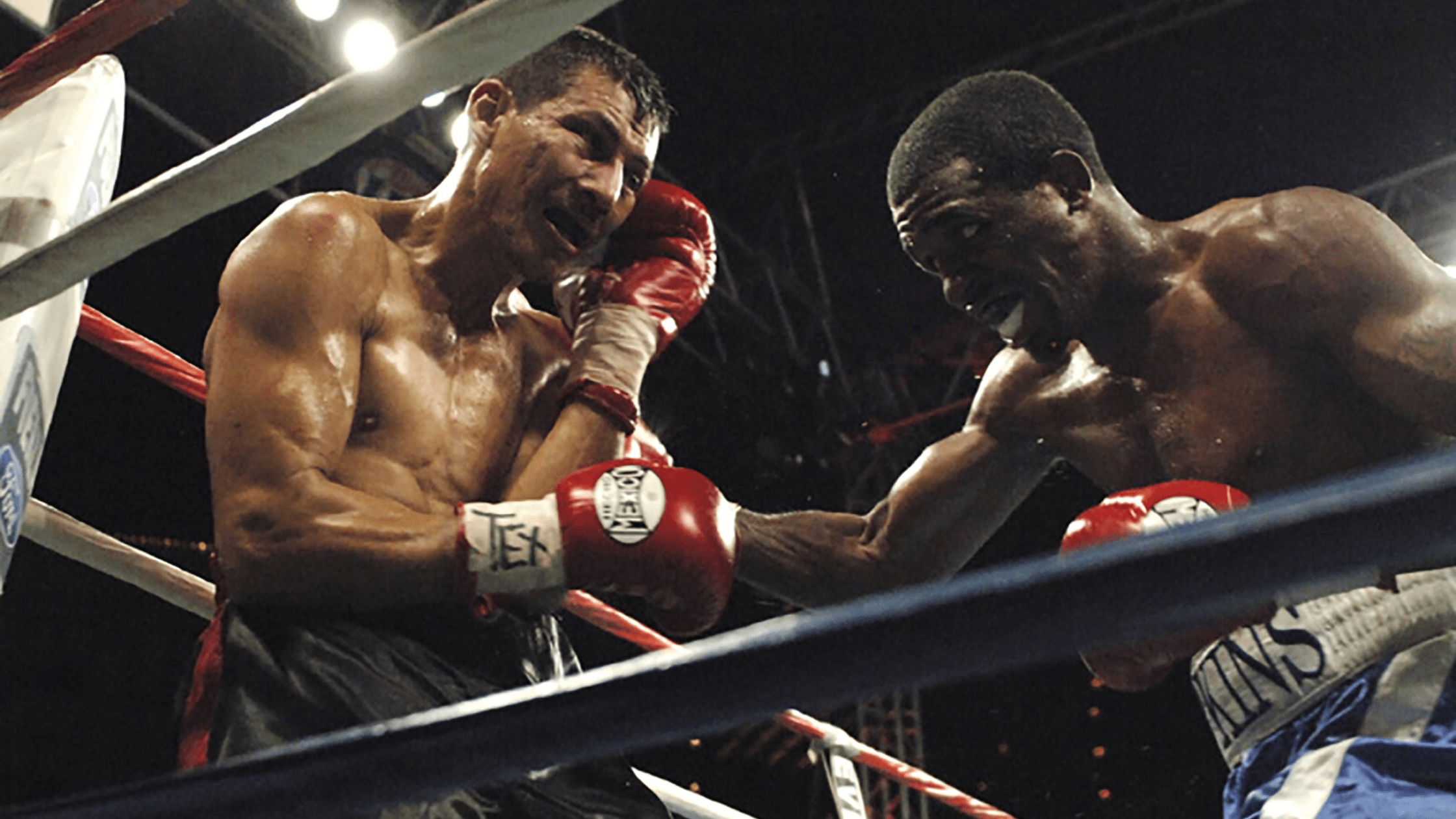

Read MoreKnow the game: what smart fans need to know about Boxing

Learn boxing's rules, scoring, and strategy to watch smarter and bet better. A smart fan’s overview of what shapes a fight’s outcome.

Read MoreKnow the game: what smart fans need to know about Snooker

Master snooker’s rules, strategy, and betting options to enjoy this tactical, high-pressure cue sport with confidence and insight.

Read MoreSpecial Report

Getting more from your food basket comparison

A comparison of online shopping baskets revealed a surprising result: food prices in major retail chains have dropped to levels seen a year ago. For instance, a shopping cart at Rimi costs less now than in the past 11 months; last year, it was over €70, and now it’s under

Read MoreEstonian property market sees 33% drop in transactions

Estonian property market sees 33% drop in transactions YoY; No Immediate Revival Expected Despite ECB Holding Off Rate Hikes Despite the European Central Bank (ECB) pausing interest rate increases, experts foresee no quick recovery for Estonia’s flagging housing market. Since last autumn, the ECB has raised rates ten times to

Read More10 best arbitrage software platforms reviewed [+ tested]

The top arbitrage betting software sites were tested and reviewed for global sports bettors. Discover what they offer, key features and what to look for when choosing arbitrage betting software.

Read MoreBest betting tipsters – what are they tipping to win today?

Discover how expert betting tipsters, strategies, and free tips can help you make informed decisions, boost profits, and improve your sports betting journey.

Read More