Special Reports

MoneyHub is committed to finding the latest information for consumers. We track down the best prices to offer the consumer the opportunity to educate themselves on their purchases.

MoneyHub experts say:

Whilst the upmost care has been taken with writing our special reports, we always urge consumers to do their research when buying products or using our advice.

Special Reports

- 1

- 2

Alternatives to borrowing money that doesn’t include your friends and family

It can be tempting to ask friends or relatives to lend you money, yet many of us hate borrowing money from friends and family. You need to carefully consider whether you can afford to repay the loan and can cope with what might happen if you can’t. Borrowing from a

Read More8 reasons why you should NOT lend money to friends & family

Loans between family members or friends can result in an entirely unexpected set of problems. Consider why you should not lend money to friends and family and some tips to help you with damage control if you do agree to loan money. Loans to family and friends are open-ended. The

Read MoreIs social media causing us to get into debt?

Extortionate rental prices, credit card bills, and student loans make it difficult for us to save for our future retirement. However, social media is a new threat impacting our financial growth and security.

Read More18 alternative investments investors should consider

Investment opportunities for inventors are becoming harder to score better returns. Alternative investments are several options that provide decent returns. But is alternative investing riskier?

Read MoreIs cat insurance worth it?

Cats may have nine lives but still need the right care if they get sick or injured. Vet bills can quickly mount up, but pet insurance can help cover these costs and ensure your cat receives the best care possible.

Read MoreDog insurance: how it helped a pet dog who developed a sudden heart condition

Every pet owner hopes to be that policyholder who’d purchased nothing more than peace of mind. But once they need it, they are happy they have it.

Read MoreGoodbye role-based salary! Hello skills-based pay!

One of the biggest changes we’re seeing is the move from traditional role-based salary structures to skills-based pay models. There is a growing recognition that an employee’s skills are often more valuable than their job title.

Read MoreCommon investment mistakes to avoid [Updated 2025]

Despite learning the lessons of history, there are still plenty of common investment mistakes that investors perform. Our updated 2024 guide will get you started for building a prosperous investment portfolio.

Read MoreUnderstanding pet insurance: A guide to protecting your furry friends

Find out what dog and cat insurance covers, what types of policies you can choose from and common exclusions to watch out for.

Read MoreComparing gyms in Estonia

Finding a fitness or health club that will meet all your personal targets and help you stay motivated requires asking some key questions, and being realistic and upfront about your goals. But how do you find the right gym? What should you be looking for? Price? Equipment? Location? Finding the

Read MoreP2P investing myths: Separating fact from fiction

A fair share of P2P investment scams have led to a rise in so-called P2P investing myths. Yet how justified are these myths? Let’s separate fact from fiction.

Read MoreWhy do so few women do investing?

Why do so few women do investing? Very few women invest, yet when they do, they statistically outperform men. Why then, are not more women investing?

Read MoreHow to save money on household utility bills

Winter is soon upon us, and many families around the country will begin to be concerned about how high energy bills will be and the cost of living through winter. Household costs like electricity, gas, water, broadband, car insurance and mobile phones consume most of our household budgets. Rather than

Read MoreHow risky is P2P lending? [And how to manage the risk]

As with any investment, there are risks to investor capital. The trick is to manage P2P lending risks so that investments are both lucrative and safe.

Read MoreGuide to buying and maintaining an aftermarket or used car?

The advantages are obvious as you will lose money as soon as you drive a car out of the showroom. If you decide to buy an older car then be sure to know what kind issues you might encounter, Moneyhub recommends following our guide. It also essential to do your

Read MoreDealing with home loan problems: what to do when you can’t pay your mortgage

If you’re having difficulty paying your mortgage or home loan or are already behind on your payments, what’s the best way to avoid losing your home? This article discusses possible solutions to difficulties in making mortgage and home loan payments but is not intended to substitute for personal legal or

Read More11 tips to know before starting P2P investing

Before starting P2P investing, consider these 11 smart tips for minimising your risk and gaining higher returns using a P2P platform.

Read More6 ways you can shave years off your mortgage

Mortgages are your biggest monthly outgoing. It would significantly boost your lifestyle if you did not have to pay this each month. There are ways to reduce your mortgage length; here are seven tips. This may sound obvious, but making additional payments can save you more in the long term.

Read MoreAre you an emotional spender?

However good you are at managing your money, your emotions can urge you to make unnecessary purchases. Are you an emotional spender?

Read MoreAre low-risk, high-return investments a myth?

Investing at its very core is simple. It's all about risk and returns. But is there a thing as a low-risk, high-return investment? MoneyHub discusses.

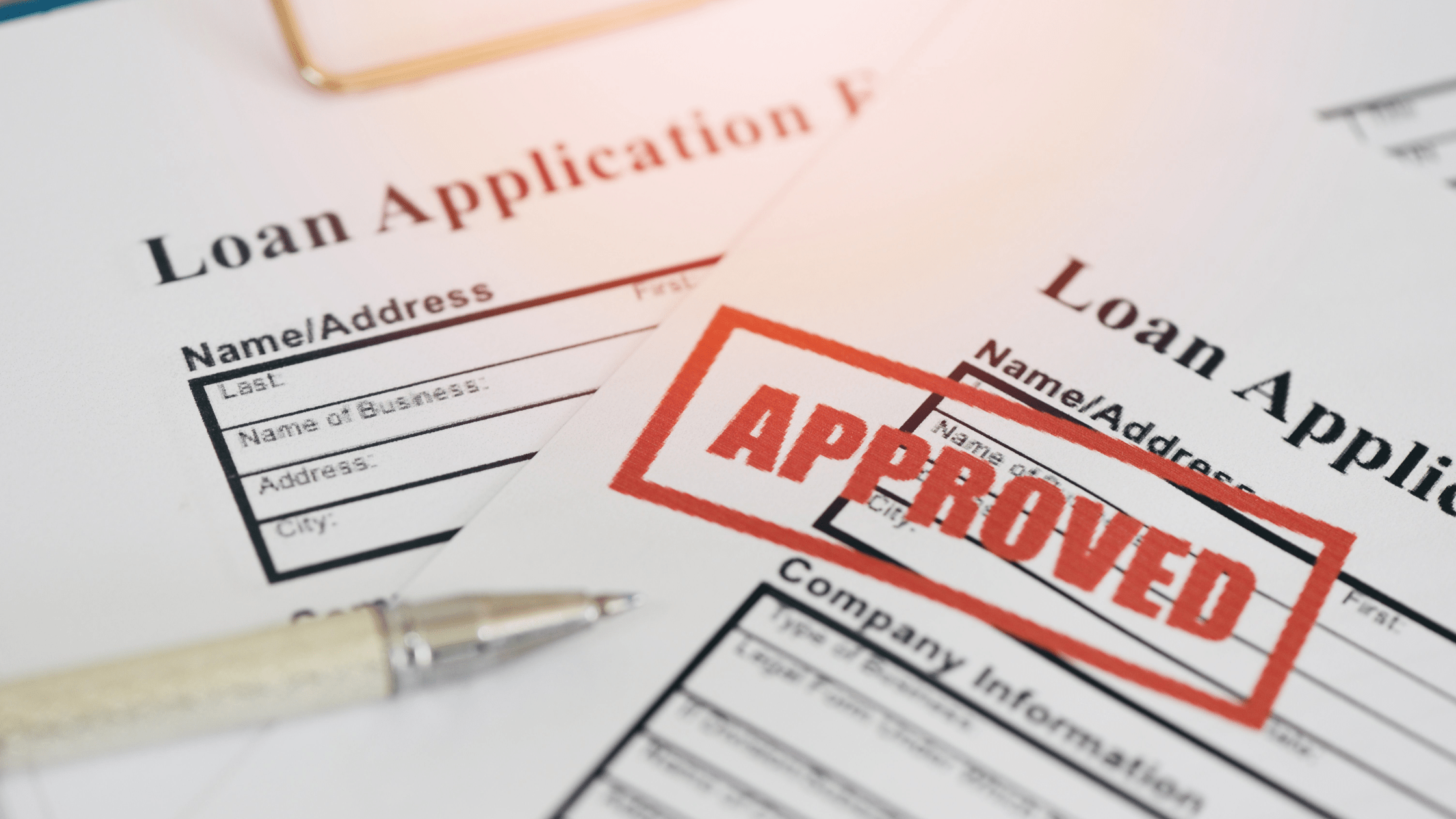

Read MoreHow to get a home improvement loan

A home improvement loan is designed to help you get more from your property, whether you're buying a new kitchen, fixing a leaky garage, or giving your property a new lease of life.

Read MoreBuilding your investments – Property investing

If you consider property investing, there are certain factors you have to take into account before deciding if it is a sound investment for you.

Read MoreThe rush for rare coins – the new alternative gold rush?

Volatile markets cause investors to flock to new alternative investment opportunities. One such strategy is investing in rare coins, the new gold rush.

Read MoreHow debt damages your personal relationship(s)

Debt can cause an unbelievable amount of pressure on relationships, causing disputes, quarrels and frustration from either partner. In a debt-ridden environment, staying strong as a couple can be challenging. Either or both partners can become cold and withdrawn from each other, leading to repeated arguments on how the debt

Read More

![How to manage your personal debt [14 strategies]](https://moneyhub.ee/wp-content/uploads/2023/10/debt-obligation-banking-finance-loan-money-concept-scaled.jpg)